The Service Design Award is currently open for submission again. Submit your project for a chance to win and present at the Service Design Global Conference in Toronto this year.

“Our NPS is falling, can you help?”

Our client is one of EU country’s pillar banks and the market leader for mortgage applications, with a 10% lead over its nearest competitor. But in 2016, this client was becoming a victim of its own success. A surge in mortgage applications put pressures on its ability to deliver a seamless experience for every customer. Gaps in the mortgage journey were driving a decline in the customer experience and ultimately NPS.

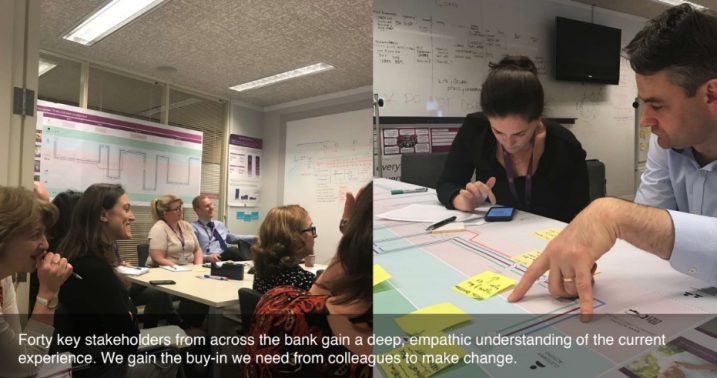

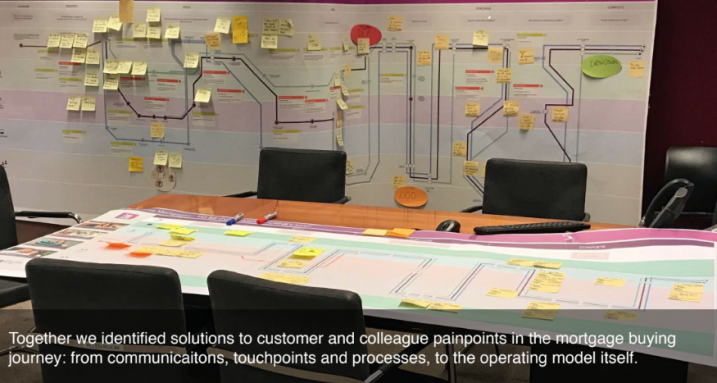

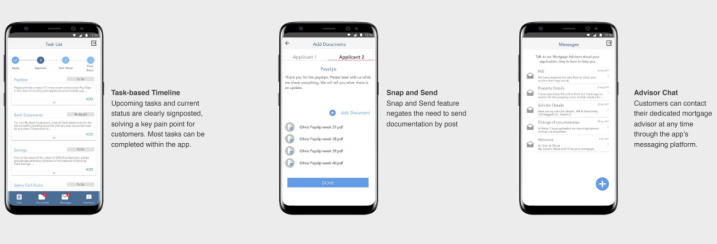

What started as a problem statement about a declining NPS score became a far-reaching programme that would bring the bank on its own journey of reimagining the entire home buying journey, while at the same transforming the bank’s ways of working. This ambitious programme would eventually span the company’s operating model, business processes, IT systems and every customer touchpoint.

Buying a home: a critical moment of truth

The relationship people have with their banks comes in to sharp focus at a few critical moments in life. Buying a house is one of those moments. Just over half of BankCo’s mortgage customers are first time buyers, which means a process that is naturally stressful is also deeply unfamiliar.

The Design team set two research work streams to establish a baseline of the current state. Our research took in business insights, voice of customer and colleague reports, operational & process data and technology insights. To flesh out the nuances of the experience, we conducted research with frontline staff across different bank branches throughout the country.

Our research showed that while customers appreciated direct interactions with BankCo staff, the process was overly long and communication often lacking. The eligibility criteria for loans was not clearly signposted, leading to a constant stream of ineligible applications that still needed to be processed. For hopeful applicants, the waiting time to receive a decision was two weeks and

longer. And once a loan was approved, many customers were frustrated by the time taken to receive their funds.

A key problem was the lack of alignment across channels. This resulted in an inconsistent experience for the many customers who switch between branch, phone and online channels during the home-buying journey. In order to solve these issues, we need to get to the root causes.

Share your thoughts

0 RepliesPlease login to comment