The Service Design Award is currently open for submission again. Submit your project for a chance to win and present at the Service Design Global Conference in Toronto this year.

Introduction

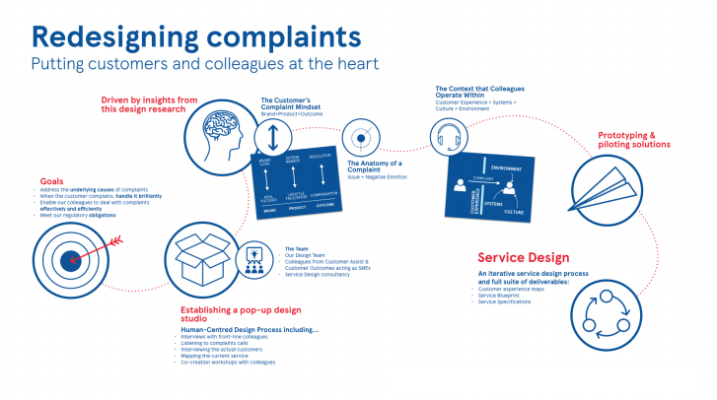

A leading UK bank asked our design practice to partner with them to design a complaints experience that would turn customers who have had their complaint resolved into advocates; empower customer service representatives to do their jobs more efficiently, and identify opportunities for long-term service improvement. The result was a strategic service redesign that has addressed the root causes of complaints, reduced the time taken to resolve a complaint by 63%.

The bank has over 5.6 million customers in the UK and is wholly owned by one of Britain's biggest supermarket retailers. It offers a full range of personal banking and insurance products. Customer Service Representatives in their UK contact centres provide service 24 hours, 7 days a week.

The client recognised that a complaint is a moment of truth in the customer experience. Handled poorly, a complaint is a source of worry that turns to frustration: it sours the relationship with a customer. The Bank is committed to delivering outstanding customer service so they asked us to work with them to improve their complaint service to align with their organisation’s values. They wanted to put customers at the heart of a service based on a framework that focused on taking ownership, making a human connection and building long-lasting customer relationships.

Process

We established a pop-up design studio in the contact centre in Glasgow bringing together a multi- disciplinary team from across the bank. Successfully resolving complaints takes a knowledgeable and empowered team of customer service representatives, backed up by complaint resolution experts and supported by experienced managers. Recognising this we bought together the customer service representatives (CSRs) who take customer calls; customer relations officers (CROs) who specialise in handling complaints; UX designers from the bank’s internal design team; the bank’s Head of Customer Care; their Customer Services Director and their Head of Digital and Marketing Strategy.

We utilised an ethnographic research approach and applied multiple methods to explore the everyday experiences of customers and complaints handlers. The research was carried out to understand the nuances and drivers of complaint experiences. We were focused on the familiar; the routines and practices that people have developed for difficult conversations, whether it was customers complaining or colleagues handling complaints. We sought to understand how people’s relationships and routines embody the beliefs and values that drive their behaviour, attitudes, and opinions. The research used 8 approaches:

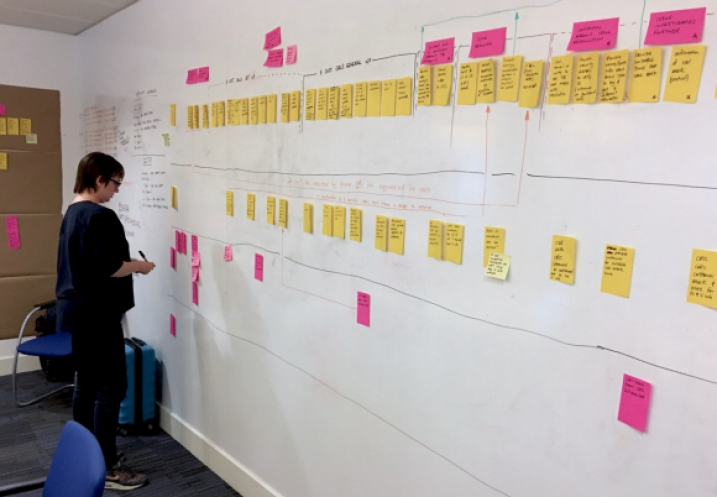

Check: The bank’s team listened to over 400 customer complaints calls, identifying the root cause of each complaint and understanding the context and origin of the customer’s complaint. They analysed the Bank’s processes for handling complaints, using complaint data to measure the effort taken in each step and the variance between outcomes. This process fed into the current state service blueprint.

Current-state service blueprint: We wanted to take a thorough and detailed look at the current service. We built on the Check process to create a working service blueprint of the current complaint experience. The process was fast: working from the existing process maps meant that we could create a service blueprint in a matter of days.

Complaint Deep Dive: In order to gain even more insight, we took a deep dive into a series of specific complaints. We listened to every call and read every correspondence related to each of these complaints. We wanted to understand the perspectives of everyone involved, so - setting our preconceptions aside - we interviewed every customer service representative and complaint resolution expert that had been involved in the complaints in some way. We then interviewed the customer who had made each complaint.

Internal Interviews: We interviewed the 30 customer service representatives and customer relations officers involved. We wanted to see complaints from both sides, and to understand how their approach, perceptions and expectations shaped the discussion and eventual outcome. We were keen to learn from customer service representatives experiences and provided a clear picture of their day-to-day jobs. It gave us a deep understanding of their values, frustrations, motivations and personal objectives in relation to their roles.

Customer interviews: We conducted 20 x 60-minute depth interviews with the customers in order to hear about each complaint from their own perspective. This enabled us to understand their relationship with and perception of the Bank’s brand, how they felt their complaint was dealt with and their expectations of complaints processes in general.

Colleague workshops: Call handlers were invited to a series of codesign workshops looking at a variety of elements in the complaints experience. These activities were well received as they helped colleagues feel involved in the process of creating outcomes rather than just being told the outcomes at the end (what they said they would have expected from previous experience). In total over 122 colleagues were involved in these workshops.

Service Pilots: Pilots enabled us to test concepts whilst identifying any issues or barriers within the organisation which may impact future initiatives.

Share your thoughts

0 RepliesPlease login to comment