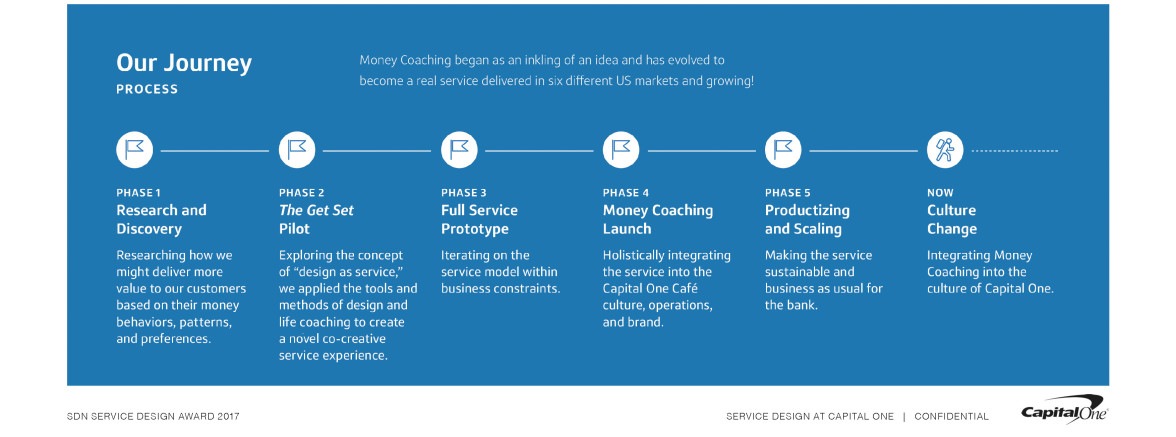

Our Money Coaching Mission

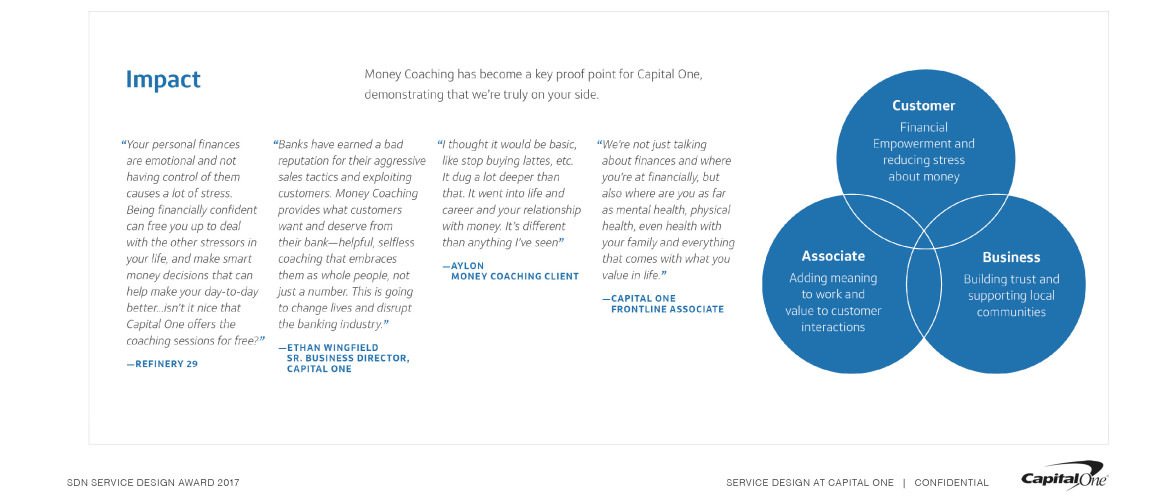

To truly differentiate from competitors, companies need to deliver new value that other players in the market are not offering. In our research, we learned that money is not just about the dollars and cents; it’s central to all the biggest decisions and moments of our lives—from marriage, to career, to children, divorce, or death. We asked ourselves, how might we better help people navigate the emotional side of money?

As a company, we are charged with doing the right thing for people. When we heard that “65% of Americans are losing sleep over their finances” (Creditcards.com), and “nearly half of Americans would have trouble finding $400 to pay for an emergency” (The Atlantic) we knew we needed to take action. Capital One responded by creating Money Coaching to help people feel more confident in their relationship to money and how they talk about it. The service takes place in Capital One’s cafes, which aim to create a comfortable, stress-free environment to get help with your money.

What is Money Coaching?

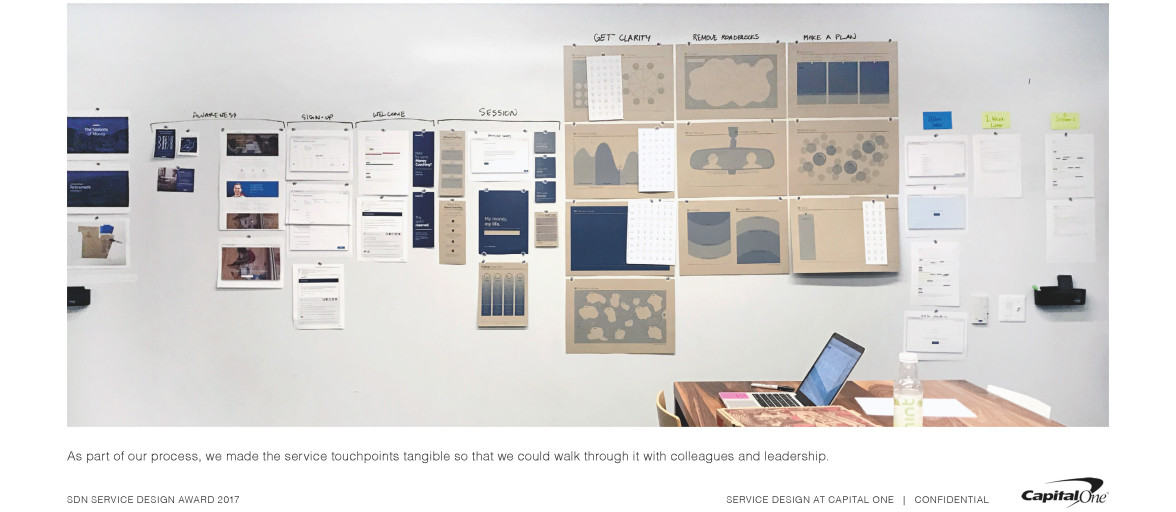

Money Coaching is a one-on-one, judgment-free guided program. It’s designed to help people build a firm financial foundation by aligning their values, beliefs, goals, and spending to move toward what they want in life.

Sessions are activity-based, designed to help discover fresh perspectives on money and develop new strategies, no matter where a person is on their personal financial journey.

Coaches are not financial advisors, accountants, or tax specialists. They help others dig deep to understand motivations and how emotions affect decision making around money.

Share your thoughts

0 RepliesPlease login to comment