A change in context provokes an internal movement

Traditional insurance markets have been suffering a setback by reason of new business models such as peer-to-peer, on demand, pay as you go, as well as due to innovative interfaces and other touchpoints that inflict less friction to the user journey. Insurtechs have had a big share on this market shift - similarly to what happened in the financial market with the fintechs - and have been pushing traditional insurance providers to keep-up with the new players.

Take care to transform claims the essence of this Brazilian insurance provider that has more than 29 years of experience, 6 million clients nationwide mainly in the health but also in the general insurance market, 1.200 employees and revenues of US$ 815 million in 2018. The organization is part of the biggest cooperative medical system in the world and together serve 18 million clients through 117 own hospitals, 2.554 accredited hospitals, and 346 health cooperatives spread throughout the country accounting for a participation of 37% in the Brazilian health insurance market.

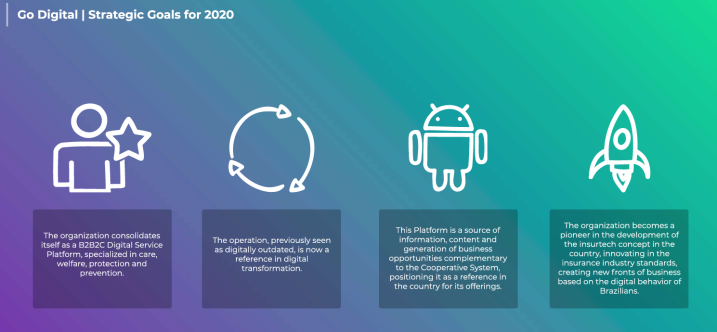

When understanding the need for change over the challenging future, in August 2016 the Board of Directors, with the participation of one Independent Director and under the leadership of a new Superintendent launched the Go Digital project aiming to transform internal processes and innovate its offerings and services. Given the failed initiatives from previous years, this leadership had no strings to the past and embraced the challenge.

Service design enters the scene

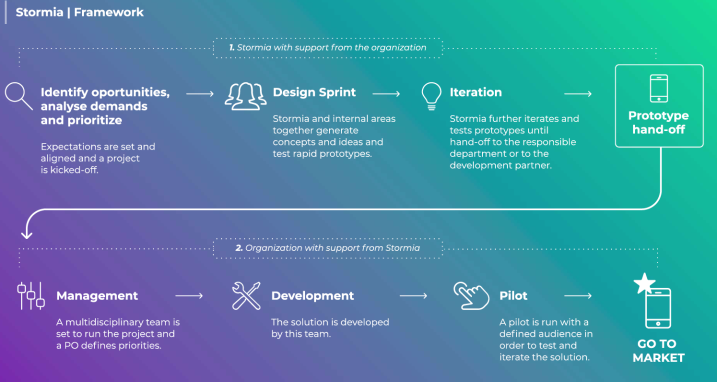

With the support of a service design consultancy firm and an external specialist in start-ups, technology and newer business models, this initiative brought the design approach, tools and methodologies to the C-level aiming to define a strategy and pave the way for innovation.

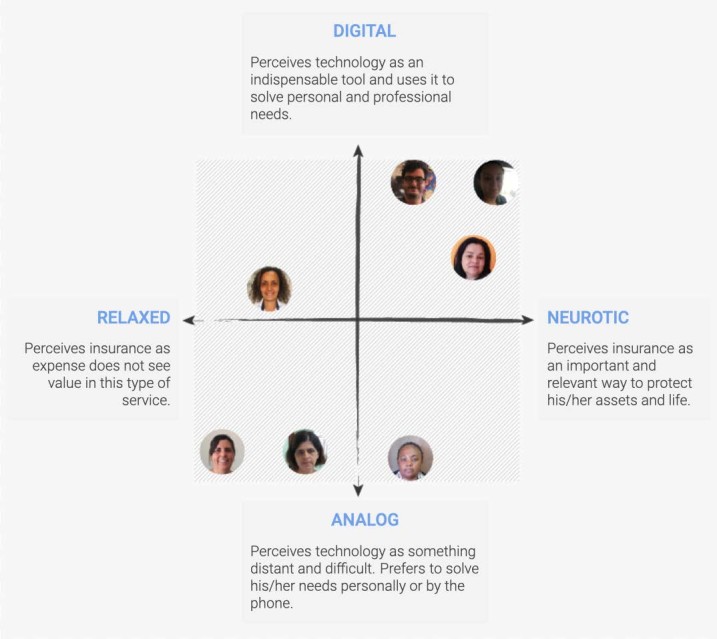

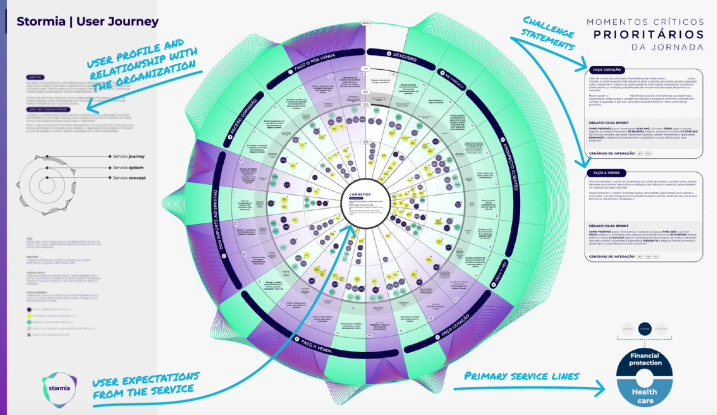

In order to broaden the project team’s understanding over the challenge and to serve as the basis for the co-creation of a new strategy, the service design consultancy took three initial steps: (1) desk research, both on local and global trends which was a starter for a specific study over the insurtech movement and its players; (2) in-depth interviews with insurance users, brokers and internal collaborators to thoroughly understand their views on this type of service; (3) collaborative deepening sessions.

Share your thoughts

0 RepliesPlease login to comment